All Categories

Featured

Table of Contents

Area 691(c)( 1) provides that an individual who consists of an amount of IRD in gross revenue under 691(a) is enabled as a reduction, for the exact same taxed year, a section of the estate tax obligation paid because the addition of that IRD in the decedent's gross estate. Generally, the amount of the deduction is computed using inheritance tax worths, and is the amount that births the same ratio to the inheritance tax attributable to the internet worth of all IRD things consisted of in the decedent's gross estate as the worth of the IRD included because individual's gross earnings for that taxed year births to the worth of all IRD items included in the decedent's gross estate.

Rev. Rul., 1979-2 C.B. 292, addresses a scenario in which the owner-annuitant purchases a deferred variable annuity agreement that offers that if the proprietor passes away prior to the annuity starting day, the called recipient might choose to receive the present collected value of the contract either in the form of an annuity or a lump-sum settlement.

Rul. If the beneficiary elects a lump-sum payment, the excess of the quantity obtained over the quantity of consideration paid by the decedent is includable in the beneficiary's gross income.

Rul (Fixed annuities). 79-335 wraps up that the annuity exception in 1014(b)( 9 )(A) uses to the contract defined in that ruling, it does not especially attend to whether amounts obtained by a beneficiary under a delayed annuity agreement over of the owner-annuitant's financial investment in the contract would certainly be subject to 691 and 1014(c). Had the owner-annuitant gave up the contract and obtained the amounts in extra of the owner-annuitant's financial investment in the agreement, those amounts would have been earnings to the owner-annuitant under 72(e).

Are inherited Flexible Premium Annuities taxable income

Furthermore, in today situation, had A surrendered the agreement and obtained the quantities moot, those quantities would certainly have been income to A under 72(e) to the level they surpassed A's investment in the contract. Accordingly, amounts that B obtains that surpass A's investment in the agreement are IRD under 691(a).

, those amounts are includible in B's gross income and B does not receive a basis change in the contract. B will certainly be qualified to a reduction under 691(c) if estate tax obligation was due by factor of A's fatality.

PREPARING Details The major author of this revenue judgment is Bradford R.

Tax consequences of inheriting a Variable Annuities

Q. How are just how taxed as strained inheritance? Is there a distinction if I inherit it directly or if it goes to a trust fund for which I'm the beneficiary? This is a terrific inquiry, however it's the kind you ought to take to an estate preparation lawyer that recognizes the details of your situation.

What is the relationship in between the dead owner of the annuity and you, the recipient? What kind of annuity is this?

Let's start with the New Jacket and government inheritance tax effects of inheriting an annuity. We'll think the annuity is a non-qualified annuity, which means it's not component of an IRA or various other professional retirement strategy. Botwinick stated this annuity would certainly be contributed to the taxable estate for New Jersey and federal inheritance tax functions at its date of death value.

Deferred Annuities inheritance taxation

citizen spouse goes beyond $2 million. This is referred to as the exemption.Any quantity passing to an U.S. citizen partner will certainly be entirely excluded from New Jacket estate taxes, and if the proprietor of the annuity lives to the end of 2017, after that there will certainly be no New Jacket estate tax on any kind of quantity due to the fact that the estate tax obligation is set up for repeal beginning on Jan. There are federal estate taxes.

The present exemption is $5.49 million, and Botwinick said this tax obligation is probably not disappearing in 2018 unless there is some significant tax reform in a real rush. Like New Jacket, government inheritance tax legislation offers a full exception to amounts passing to making it through united state Following, New Jacket's inheritance tax.Though the New Jersey estate tax obligation is arranged

to be repealed in 2018, there is noabolition set up for the New Jersey inheritance tax, Botwinick said. There is no federal inheritance tax obligation. The state tax obligation is on transfers to everybody besides a certain course of individuals, he stated. These include spouses, kids, grandchildren, parent and step-children." The New Jersey estate tax relates to annuities simply as it relates to other assets,"he stated."Though life insurance coverage payable to a certain beneficiary is excluded from New Jacket's estate tax, the exemption does not put on annuities. "Currently, earnings taxes.Again, we're assuming this annuity is a non-qualified annuity." In a nutshell, the profits are tired as they are paid. A portion of the payout will be dealt with as a nontaxable return of investment, and the incomes will certainly be taxed as ordinary income."Unlike inheriting various other assets, Botwinick claimed, there is no stepped-up basis for inherited annuities. If estate tax obligations are paid as a result of the addition of the annuity in the taxable estate, the beneficiary may be entitled to a reduction for acquired revenue in regard of a decedent, he claimed. Annuity payments are composed of a return of principalthe cash the annuitant pays into the contractand passiongained inside the agreement. The passion part is strained as common revenue, while the principal quantity is not tired. For annuities paying over an extra prolonged period or life span, the principal part is smaller, resulting in fewer taxes on the monthly repayments. For a couple, the annuity contract may be structured as joint and survivor so that, if one partner passes away , the survivor will certainly remain to obtain surefire payments and enjoy the very same tax deferral. If a recipient is called, such as the couple's children, they end up being the recipient of an inherited annuity. Recipients have multiple alternatives to consider when picking just how to get money from an inherited annuity.

Table of Contents

Latest Posts

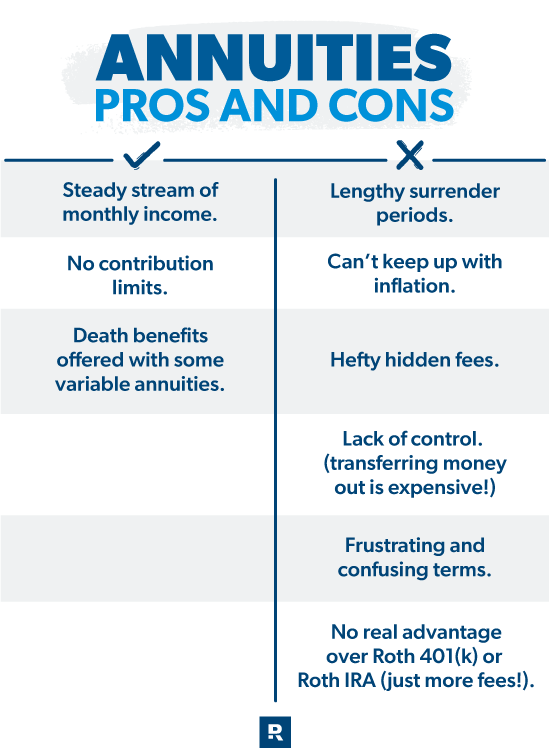

Breaking Down Immediate Fixed Annuity Vs Variable Annuity Everything You Need to Know About Financial Strategies What Is Annuities Fixed Vs Variable? Benefits of Pros And Cons Of Fixed Annuity And Var

Decoding How Investment Plans Work Everything You Need to Know About Fixed Index Annuity Vs Variable Annuity Breaking Down the Basics of Variable Annuities Vs Fixed Annuities Advantages and Disadvanta

Breaking Down Your Investment Choices A Closer Look at Tax Benefits Of Fixed Vs Variable Annuities Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Deferred Annuity Vs Vari

More

Latest Posts